Preambule

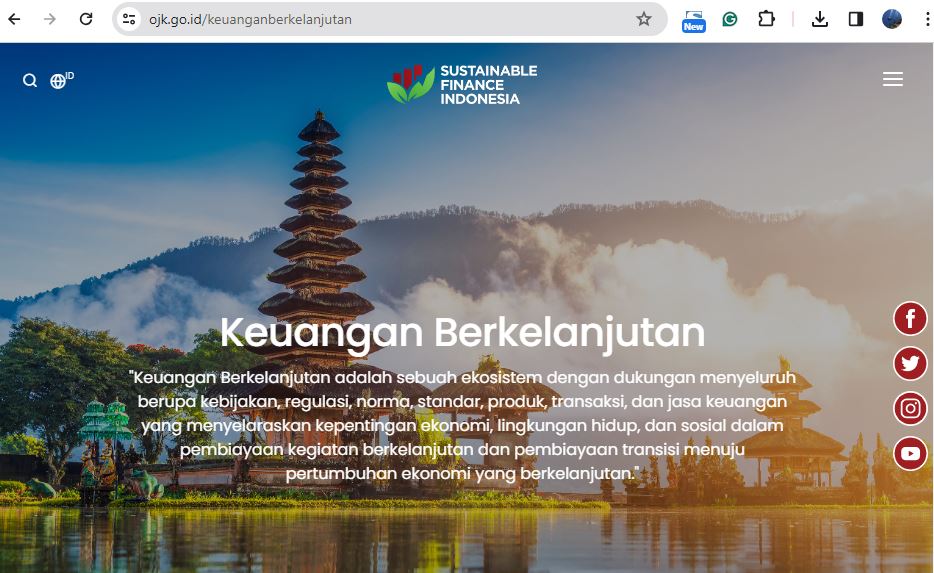

Sustainable Finance is an ecosystem with comprehensive support in the form of policies, regulations, norms, standards, products, transactions and financial services that harmonize economic, environmental and social interests in financing sustainable activities and financing the transition to sustainable economic growth (Law of the Republic of Indonesia Number 4 of 2023 concerning Development and Strengthening of the Financial Sector). In implementing Sustainable Finance, Indonesia still faces various challenges, including convincing businesses and the public that efforts to generate profits will be better and more lasting if done by considering natural resources and social impacts on society. This is known as the profit, people, planet (3P) principle. Thus, an initiative is needed that can change the mindset of businesses from pursuing short-term profits to long-term prosperity. OJK has started the efforts to overcome these challenges by encouraging the application of Sustainable Finance Principles as stipulated in the Financial Services Authority Regulation Number 51/POJK.03/2017 concerning the Implementation of Sustainable Finance for Financial Services Institutions, Issuers, and Public Companies. The Journey of sustainable finance policy development that has been carried out by OJK as follows.

Timeline Journey Keuangan Berkelanjutan OJK

Development of Sustainable Finance Information Hub (SFIH)

Development of SFIH as an integrated information channel on the development of sustainable finance.

POJK Number 51/POJK.03/2017 Issuance

OJK Regulation Number 51/POJK.03/2017 on the Implementation of Sustainable Finance for Financial Services Institutions, Issuers, and Public Companies is an overarching rule that regulates the implementation of Sustainable Finance in Indonesia.

POJK Number 60/POJK.04/2017 Issuance

POJK Number 60/POJK.04/2017 concerning the Issuance and Requirements of Green Bonds is a provision that regulates the obligations of issuers in issuing Green Bonds and regulates Environmentally Based Business Activities.

Bali Center for Sustainable Finance

OJK in collaboration with Udayana University Bali launched the Bali Center For Sustainable Finance as an effort to provide an integrated information and study center on Sustainable Finance.

Sustainable Finance Roadmap Phase I Issuance

The Sustainable Finance Roadmap Phase I contains an explanation of the sustainable finance program work plan for the financial services industry under the authority of OJK, namely Banking, Capital Markets and Non-Bank Financial Industry (IKNB).

KDK Number 24/KDK.01/2018 Issuance

KDK Number 24/KDK.01/2018 regulates incentives in the form of a discount on the Green Bond Registration fee to 25% of the original fee.

Sustainable Finance First Movers

Indonesia became the First Mover for Sustainable Finance Initiatives in Emerging Countries based on the Country Progress Report by Sustainable Banking Network (SBN).

Sustainable Finance Incentives

OJK supports the Acceleration Program for Battery-Based Electric Motor Vehicles (KBL BB) launched by the Government in Presidential Regulation No. 55/2019, by encouraging national banks to participate in achieving the program.

Sustainable Finance Roadmap Phase II Issuance

The Phase II Roadmap focuses on creating a comprehensive sustainable finance ecosystem, involving all relevant parties and encouraging the development of cooperation with other parties.

Sustainable Finance Incentives 2021

OJK continues to support the acceleration of battery-based electric motor vehicles launched by the government, by encouraging national banks to participate in achieving the program.

Establishment of Sustainable Finance Task Force

OJK established the Sustainable Finance Task Force in Financial Services as an effort to realize the development of a Sustainable Finance Ecosystem, as well as a form of support for OJK's commitment to climate change mitigation and adaptation efforts.

Indonesia Green Taxonomy Issuance

Indonesia Green Taxonomy is a classification of economic activities that support efforts to protect and manage the environment and mitigate and adapt to climate change.

Principles for the Effective Management and Supervision of Climate-related Financial Risks Consultative Paper

Holistic approach in addressing climate-related financial risks to the global banking system and seeks to improve banks' risk management and supervisory practices in this area.

POJK Number 14/POJK.04 of 2023 Issuance

Regulations that provide the requirements and procedures for licensing carbon trading through the Carbon Exchange.

Launching of Indonesia Carbon Exchange (IDX Carbon)

The Carbon Exchange is a system that regulates Carbon Trading and/or records ownership of Carbon Units in Indonesia.

POJK Number 17 of 2023 Issuance

Regulations that provide the implementation of good governance principles in banks in the implementation of business activities.

POJK Number 18 of 2023 Issuance

Regulations that provide the issuance and terms of debt securities and Sustainability-Based Sukuk.

Launching of Indonesia Taxonomy for Sustainable Finance

TKBI was developed by emphasizing the principles of scientific and credible, interoperable and supporting national interests, and inclusive.

Launching of Climate Risk Management & Scenario Analysis (CRMS) Guidelines

CRMS is an integrated framework covering aspects of governance, strategy, risk management and disclosure to assess the resilience of banks' business models and strategies in the face of climate change.

Sustainable Finance Roadmap

Sustainable Finance Roadmap Phase II

OJK developed the Sustainable Finance Roadmap Phase II (2021 - 2025) to accelerate the implementation of environmental, social and governance principles in Indonesia.

Read MoreTask Force Keuangan Berkelanjutan

The Phase II Roadmap focuses on creating a comprehensive sustainable finance ecosystem, involving all relevant parties and encouraging the development of cooperation with other parties.